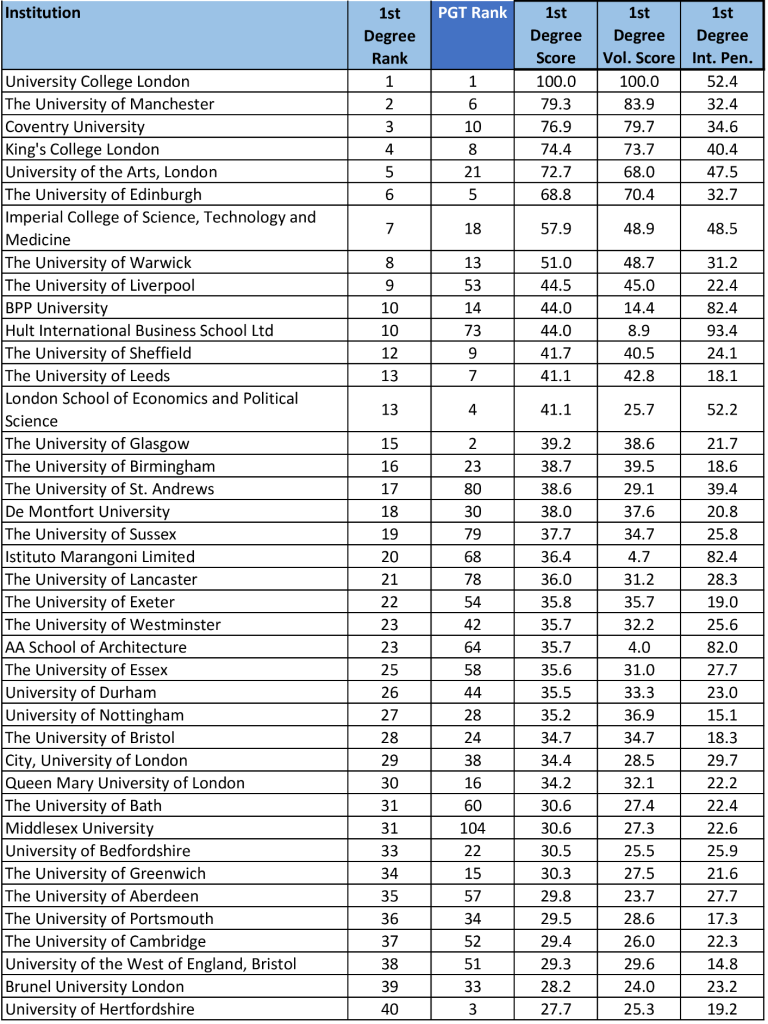

UG Recruitment Ranking Table

Recent performance and projections

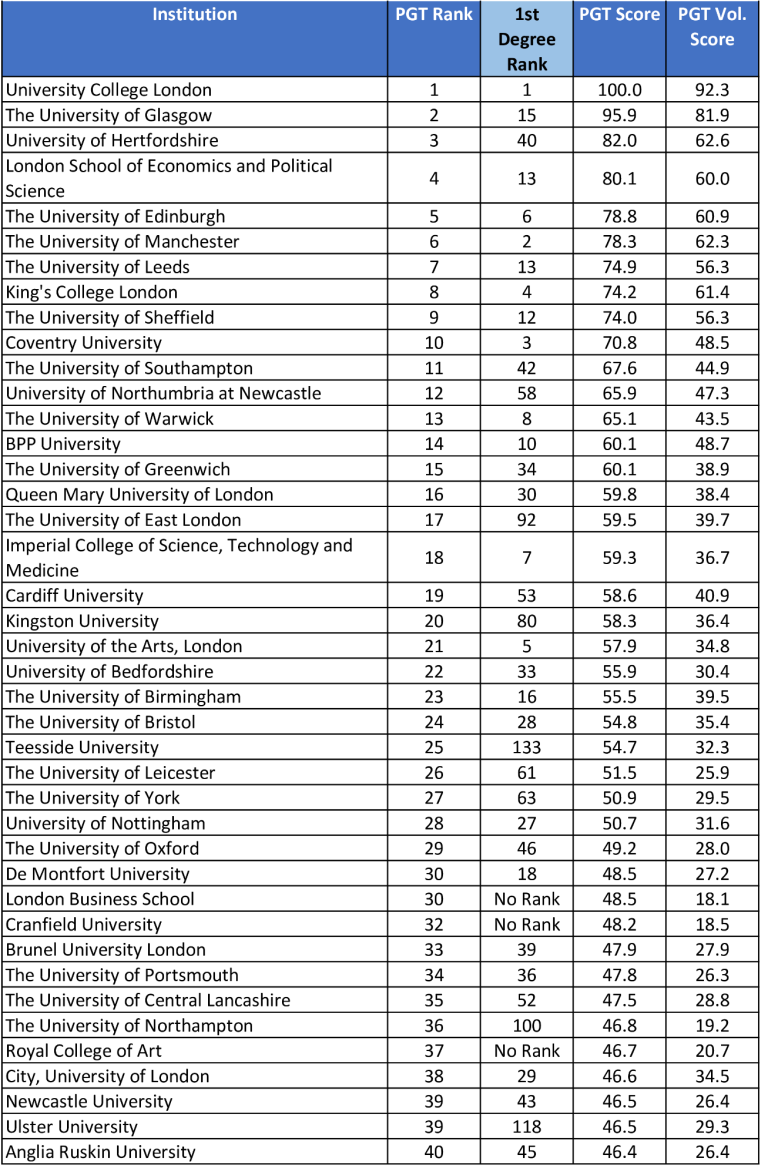

PGT Recruitment Ranking Table

Recruitment Performance by Level of Study

UG recruitment performance

Undergraduate recruitment was less dramatic than PGT with just 2.7% growth across the 2 years... still quite impressive given what was happening across much of the world.

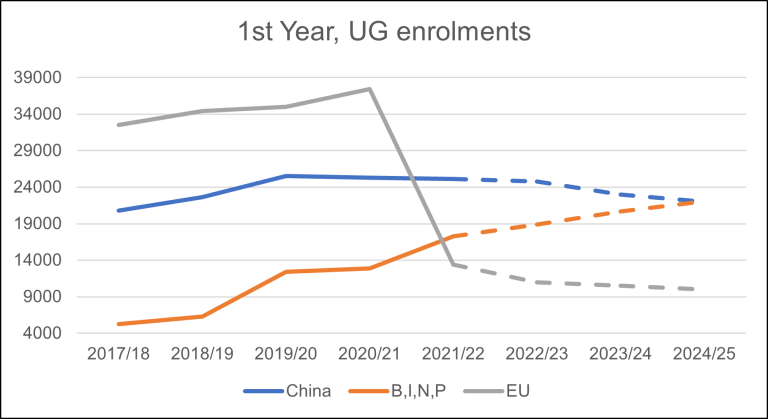

China

Ability to retain Chinese students was a key item for those at the top of the table.

The University of Liverpool is an example of one that still performs strongly in this ranking, but for whom underlying data shows large declines in new Chinese UG students which will filter through to smaller overall volumes this year and next.

Chinese 1st year, UG enrolments declined from 20/21 to 21/22, whilst UCAS applicants from China for '23 entry have also decreased for the first time in many years, suggesting China volumes will continue to struggle for most. The impact of lifting Covid restrictions may improve the outlook slightly.

EU

Hugely influential ss dependency on EU students. 21/22 was the year when 1st year, EU UG entrants truly crashed. With the length of UG degrees, the impact of this will be spread across a few years... but as an example, the University of Bedfordshire had 1455 1st year, UG enrolments from the EU in 20/2, in 21/22 this had fell to 30... with similar stories at the University of West London and Anglia Ruskin University amongst others. Overall decline in new EU enrolments was 62%. Shocking numbers and a big concern for many universities and departments.

Opportunities

South Asia and Nigeria have offered opportunity to those looking for regions to boost numbers. Whilst UG numbers are much smaller, and quite reliant on pathway programmes for countries such as Nigeria, Bangladesh and Pakistan (India less pathway dependent). With these 4 countries likely to match China for UG enrolments in the next couple of years institutions need to ensure they and their pathway partners have effective UG channels and offerings in these markets. Strong new entrant volumes here from universities such as Coventry, Hertfordshire, DeMontfort and Greenwich suggest that offerings need to offer value, and that metropolitan hubs continue to have the most obvious pull.

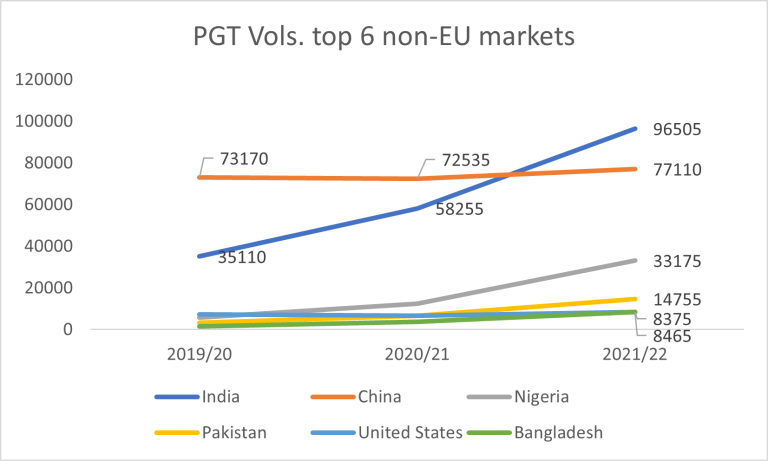

PGT recruitment performance

Some significant changes have occurred since before the pandemic. Reports from many also indicate that some of the institutions that have achieved very high PGT growth in the past couple of years have continued to grow into 22/23.

The rate of growth does bring debate around the extent to which some of the recruitment is sustainable or responsible. How are universities ensuring that the quality of student experience is preserved? Are students getting the outcomes they are expecting/being sold.

Given the high proportion of growth coming from South Asia and Sub-Saharan Africa, where research repeatedly indicates strong student interest in work opportunities during and after graduation in the UK, what checks and balances are in place to ensure students are getting positive outcomes. The decision to discontinue HESA collection of international graduate outcome data looks increasingly short-sighted given the recent surge in students.

If you'd like an excel copy of the rankings or to discuss any of the content please complete our contact form and we'll send one over ASAP.

Higher Insights Ltd. / 19 Townsfield, Silverdale, Carnforth, Lancashire / Company number 14686043

© Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.