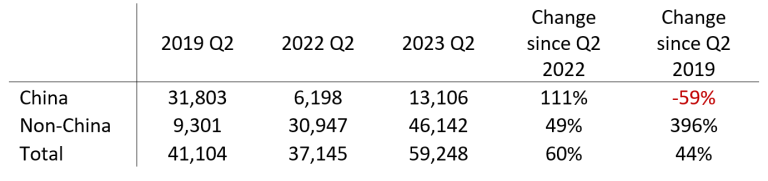

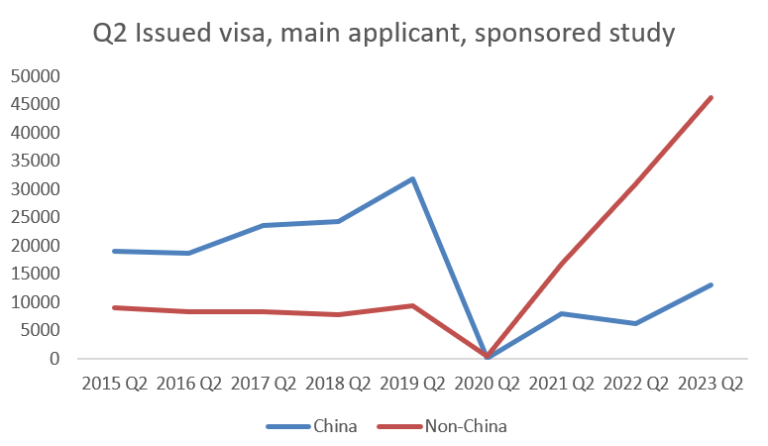

1. China recorded strong growth in Q2 but was still way below Q2 2019

2. In Q2 2019 China accounted for 77% of all issued study visas.

In Q2 2023, Non-China accounted for 77% of all issued student visas.

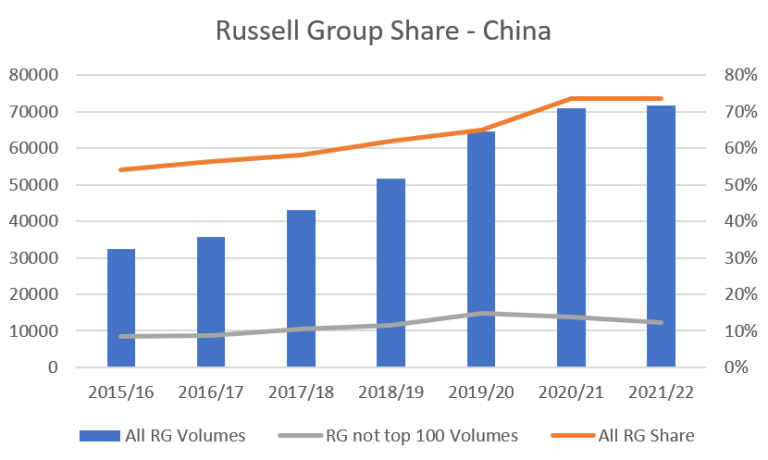

3. RG have been steadily increasing their share of Chinese students. More recently, RG institutions ranked in the top 100 globally by QS have grown their China numbers the most.

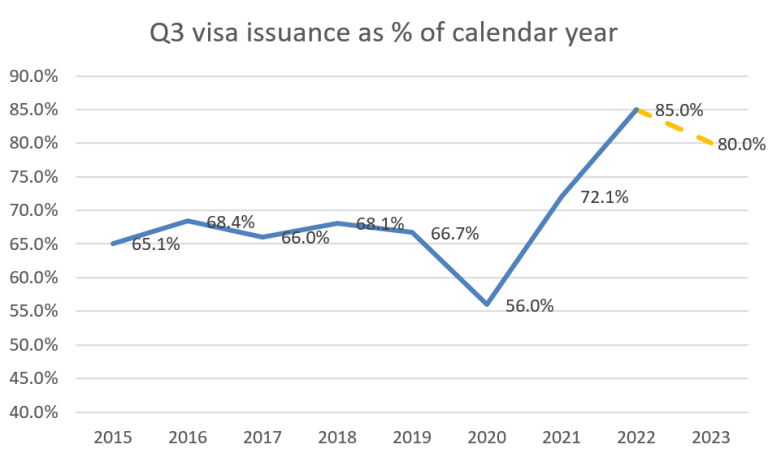

4. The percentage of Chinese students arriving in Q3 increased significantly over the pandemic as many took PSE online and then came to the UK. The number doing this seems likely to have declined significantly in 2023.

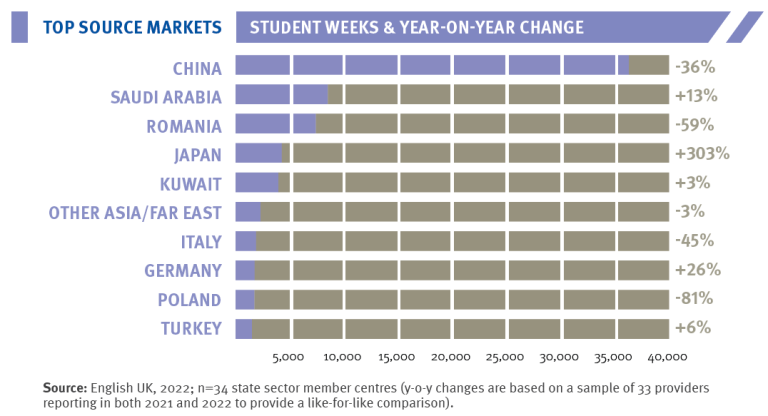

5. Despite declines in student weeks from China, it was still comfortably the top source market for state sector member of English UK in 2022.

UK Quarter 2 visa statistics and China

Recent Q2 visa statistics release seemed to offer some good news.

Study visas issued to main applicants increased by 60% vs. Q2 2022, and were 44% higher than Q2 in 2019.

The data for China is different. Q2 2023 figures were up an impressive 111% on Q2 2022, but down 59% compared to Q2 2019 (images 1& 2).

Why the huge difference in share since Q2 2019 for China vs. Rest of the World (RoW)?

There are 3 key elements at play, that make China very different to RoW:

1. China is a mature market

RoW performance has been driven by fast growth markets such as India, Nigeria, Bangladesh etc. China, with its weakening demographics for outbound mobility, was never likely to outperform its pre-pandemic levels.

2. Institution of study

Most students from the fast growth markets have been going to non-Russell Group (RG) institutions. This is evidenced by visa applications in the year to Q2 2023 being up 30% overall, but up just 8% for RG. Chinese students mainly go to RG institutions, with an even greater share heading to QS top 100 ranked RG institutions in recent years (image 3).

3. Programme of study

Due to different institution choices and English language levels, most Chinese students come in Q2 to take Pre-sessional English (PSE).

RoW are more likely to be arriving for Spring or Summer starts either for direct degree entry or Pre-Masters programmes. These types of programmes are far less common at RG institutions.

What Q2 data suggests in relation to Pre-sessional English (PSE) enrolments, and the implication for Q3 arrivals

Pre-pandemic around 2/3 of annual Chinese study visas would be issued in Q3. In 2021 and 2022 this percentage surged to 72% and then 85% (image 4).

This was because, even after in-person study was chosen by most for their degree study, online PSE continued to be offered and taken up by a large number of Chinese students. A quick Google today for online Pre-Sessional English still produces prominent RGIs at the top of search returns.

The increase in Q2 visa issuances to China suggests more Chinese students are taking PSE in the UK. This is backed up by conversations I've had with people working across UK HE.. with suggestions that we have gone from a large majority taking PSE online in 2022, to a minority (albeit still a significant one).

This is backed up by data from English UK, in which state sector data* on ELT volumes showed the percentage of students (from all countries) studying exclusively online was 49% in 2020, 71% in 2021, but dropped back to 32% in 2022. This data, combined with the higher propensity of Chinese students to study online, its position as the top country for student weeks in the state ELT sector (image 5) point to a high proportion of Chinese students studying PSE online in 2022.

*English UK state sector members include 16 university language centres, the associated unversities of which account for nearly 1/5 of all reported Chinese students in HESA 21/22.

Predicted Q3 arrivals from China

It's hard to be precise due to the erratic recent data and myriad of factors that affect final decisions... However, looking at China performance for competing countries, we see numbers rising steadily but not to pre-pandemic levels. Meanwhile in the UK we've seen a 10% drop in Chinese accepted applicants through UCAS. We've aslo seen numerous reports of Chinese students being less inclined to travel long distances for overseas study.

For me this seems to suggest that a slight decline in Chinese students this autumn is likely, predominantly due to increased competition from traditional and newer competitors. Universities in the QS top 100 best protected from this (so it'll be interesting to see how the University of Notthingham is affected by its dropping out of the QS top 100 in 2022, though it's back to =100 in the 2024 rankings).

Looking ahead, with the Chinese ban on recognition of online programmes, we'd expect to see a return to more normal patterns of visa issuance in 2024 and fewer Chinese students taking online PSE.

As ever, we'll be very interested in what visa data for Q3 tells us, as well as UCAS end of cycle data (as well as US visa data if they come back from their SEVIS reporting holiday!).

Higher Insights Ltd. / 19 Townsfield, Silverdale, Carnforth, Lancashire / Company number 14686043

© Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details and accept the service to view the translations.