The 2023 edition contains a huge quantity and range of insights

Trend for increasing proportion of graduate students continues

Understand your entry requirements and the associated market share.

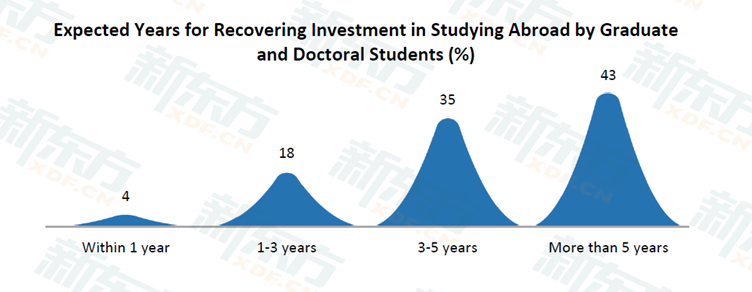

Many students expect it to take at least 5 years to recoup their investment in studying overseas.

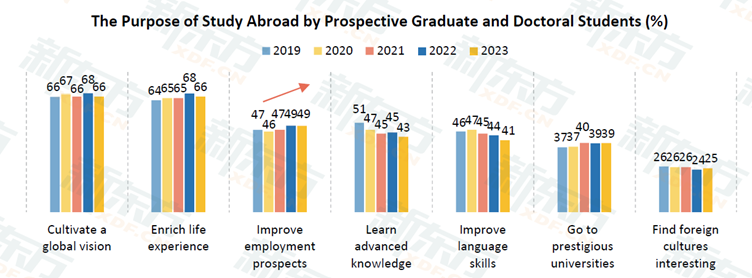

Importance of employment up, advanced knowledge & language down

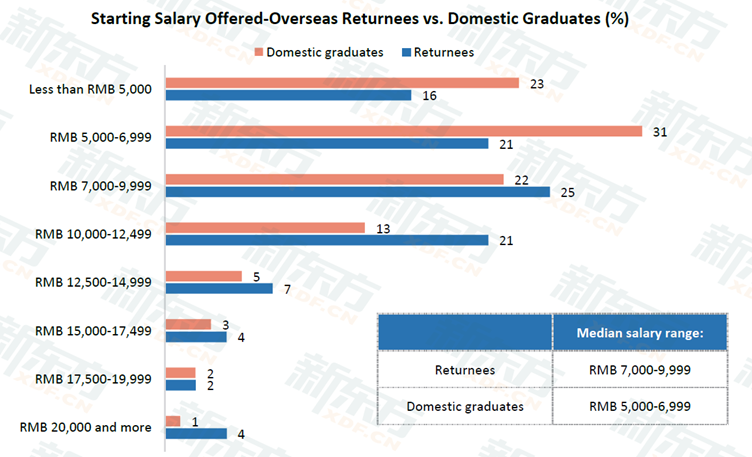

Salaries for overseas graduates are significantly higher than for domestic, and continue to rise as the economy bounces back.

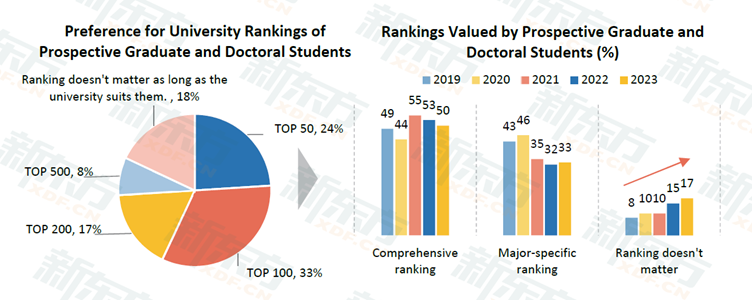

More saying rankings don't matter, but most students still want "top 100". Overall ranking more important than subject specific to most

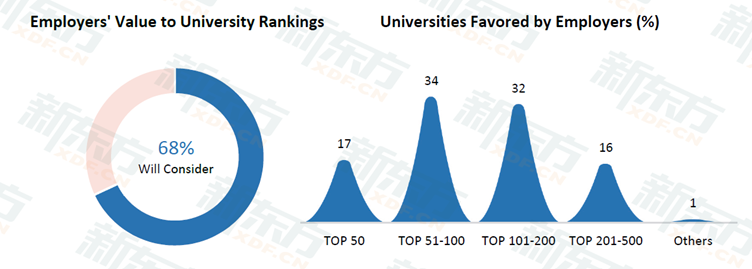

Employers still placing significant emphasis on institution ranking.

All English speaking destinations benefitting post-pandemic

New Oriental 2023 report on Chinese Students - Part 1

New Oriental Vision Overseas (NOVO) Consulting Company is a subsidiary of China's largest private education provider, New Oriental Education & Technology Group.

With a counsellor headcount of c.4,000 and over 60 offices in China, NOVO is the largest education agency in China. It is AIRC and ICEF certified and works with universities globally.

The report is based on nearly 10,000 responses from:

- Prospective students

- Parents

- Chinese graduates

- Employers

Produced with Kantar it is one of the best sources of intelligence available on study trends of Chinese students.

More graduate enquirers

This is a gradual long-term trend for NOVO.

Key reasons for the increase in Masters enquiries are:

- Cost and time effectiveness of Masters degree programmes overseas

- Limited availability of graduate places on Masters programmes in China.

- Slower economic growth has lead to a very tough job market, with nearly 1 in 5 graduates unemployed, many employers are now asking for graduate level degrees

With cost an increasing concern, there are opportunities for providers offering a combination of quality and affordability.

Succinct careers pitches, with hard detail on work experience and graduate outcomes would be a significant USP.

With 12% of enquirers looking at doctoral study, institutions looking to increase their PhD numbers will want to ensure that their processes for handling interest is smooth and as expedient as possible.

Preparation programmes for PhD study might help attract interest. Demand for research project services from NOVO has soared in the past 2 years.

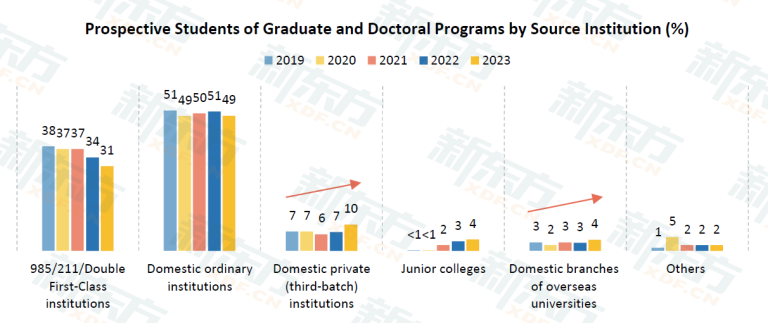

Fewer elite graduates and possible implications

In 2019 38% of graduate enquirers were from elite institutions (211, 985 or Double First Class). By 2023 this has dropped to 31% in 2023.

There has been an increase in enquirers coming from 3rd class institutions and junior colleges.

Looking at data on source institutions over the past 5 years, it does look to be an establishing trend.

For universities with high entry requirements, this will mean a reduction on pool of qualified students.

For institutions with lower entry requirements and pathway providers this could be an opportunity.

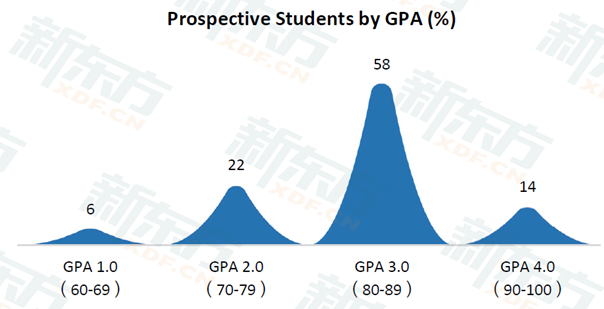

The report also shares information on GPA of enquirers... indicating 14% of enquirers holding the very highest GPAs and 58% of enquirers having a GPA of 3.0 to 3.9. This leaves 28% of enquirers coming with a GPA of 2.9 or lower.

Admissions requirements should be clear internally and externally, with a clear indication of how entry reqiurements vary according to institution type.

Household incomes and cost concerns

Recent research from Ka Ho Mok and Yu Baohua (see CGHE lecture) shows cost is an increasing concern (in their research tuition was the most frequently cited pull factor, with living costs no.2).

The New Oriental report offers additional data to explain this:

- Ave. household income of prospective students is £45k p/a

- 43% had a household income of £32k p/a or lower

- 29% of prospective Masters students had a budget of £32k

- 73% of parents are middle management or ordinary employees

- 31% of students found actual expenses overseas to be higher than expected

- 38% had concerns over expenses in 2023 vs. 28% in 2022.

- 43% of students expect it to take at least 5 years for them to recoup their investment in overseas study

As NOVO is a big brand agency with relatively high counselling fees, it is likely the budget and income of their students is higher above average.

Having a cost effective option opens up a significant proportion of the market to those unable to compete on brand/rankings with the top RG unis and could also influence those comparing competing RG options.

Employability continues to rise in importance

Top level drivers of study abroad remain quite consistent, with a slight increase in the importance of employment prospects and significant declines in those going abroad to gain advanced knowledge or for language improvement.

The challenging job market where many employers demand postgraduate qualifications and the difficulty of accessing a graduate degree in China is driving many overseas for study, whilst the improving profile and rank of domestic institutions alongside broad improvements in English language levels make advanced knowledge and language lower priorities.

Recent research pieces indicate many organisations view those with overseas study experience positively, and that these students are paid better than domestic educated counterparts. This is confirmed in this paper, which indicates overseas returnees are over 50% more likely to be offered a starting salary of 10,000 RMB per/month.

Strong communication of international learning/environment and life experiences can still be a key differentiator in communications.

Decline in importance of rankings for students

Rankings are still very important, but an increasing number of students are saying it doesn’t matter.

Often seen as a big obstacle to non-elite institutions in recruiting Chinese students, the trend up until recently had been for rankings to become more and more important.

But.... Parents & employers still heavily rankings influenced

Despite the shift in influence the “rankings phenomenon” is still strong. A recent ChinaICAC report said many high school counsellors struggle getting students to choose "best fit" over ranking. Parents are even more rankings obsessed, with the same report giving rankings as the most commonly cited concern for parents (94% ahead of safety at 79%!).

Critically we still see employers having strong preferences for students returning from highly ranked universities. Over half having a preference for students from top 100 ranked universities… and over 80% wanting students from top 200. Until we see this trend reversing, there’s unlikely to be a huge turnaround in the “ranking phenomenon”.

As such, from a recruitment perspective, when looking to attract Chinese students, having a ranking in the top 100 or 200 is still a big draw.

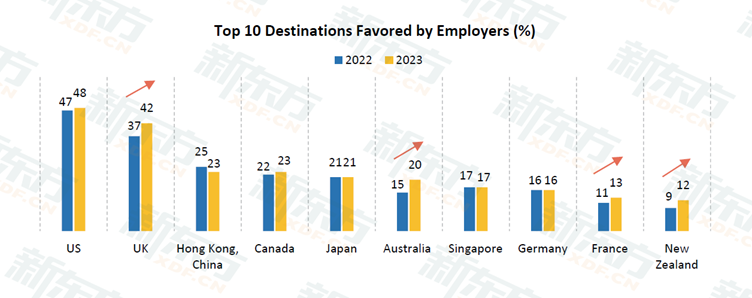

Positive employer view of returnees particularly from MELD

84% of employers surveyed found overseas study meaningful and associated with multiple benefits.

Employers are also keen for returnees to have work or internship experience as well as relevant qualifications or awards.

If you are aiding you students in obtaining any of these items, you should be highlighting it. If not, why not?

United States and United Kingdom top the popularity charts with employers, with an increase in popularity of all English language destinations post-pandemic.

Whilst no increase in popularity of Asian destinations, we can see that Asian countries with strong education systems do hold good currency with employers.

Higher Insights Ltd. / 19 Townsfield, Silverdale, Carnforth, Lancashire / Company number 14686043

© Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.